Compare the AP creditor’s turnover ratio to the accounts receivable turnover ratio. You can compute an accounts receivable turnover to accounts payable turnover ratio if you want to. Are you paying your bills faster than collecting invoices from customer sales? If so, your banker benefits from earning interest on bigger lines of credit to your company. If the accounts payable turnover ratio decreases over time, it indicates that a company is taking longer to pay off its debts.

Interpretation & Analysis

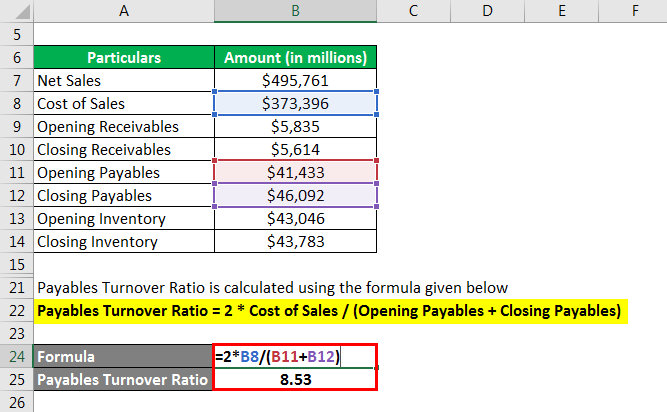

Overall, it is beneficial to analyze these two ratios together when conducting financial analysis. The average payables is used because accounts payable can vary throughout the year. The ending balance might be representative of the total year, so an average is used. To find the average accounts payable, simply add the beginning and ending accounts payable together and divide by two. This ratio helps creditors analyze the liquidity of a company by gauging how easily a company can pay off its current suppliers and vendors.

What a High AP Turnover Ratio Means

To compare your ratio with industry averages, calculate your company’s ratio using the formula and compare it with the industry averages. The total purchases number is usually not readily available on any general purpose financial statement. Instead, total purchases will have to be calculated by adding the ending inventory to the cost of goods sold and subtracting the beginning inventory. Most companies will have a record of supplier purchases, so this calculation may not need to be made. The rules for interpreting the accounts payable turnover ratio are less straightforward. The investor can see that Company B paid off its suppliers at a faster rate than Company A. That could mean that Company B is a better candidate for an investment.

Ready to save time and money?

In the case of our example, you would want to take steps to improve your accounts payable turnover ratio, either by paying your suppliers faster or by purchasing less on credit. But there is such a thing as having an accounts payable turnover ratio that is too high. If your business’s accounts payable turnover ratio is high and continues to increase with time, it could be an indication you are missing out on opportunities to reinvest in your business. Before you can understand how to calculate and use the accounts payable turnover ratio, you must first understand what the accounts payable turnover ratio is.

Where can you see your ending accounts payable balances?

Over time, your business can respond to new business opportunities and changing economic conditions. Improve cash flow management and forecast your business financing needs to achieve the optimal accounts payable turnover ratio. However, it should be noted that this metric cannot directly be compared across different industries or company sizes. Many variables should be examined in conjunction with accounts payable turnover ratio. Only then can you develop a complete picture of a company’s financial standing.

You should be aware, however, that an acceptable result for the payable turnover ratio varies from industry to industry. If your ratio is below 5.2, creditors might be more concerned, but it could also mean that you’re deliberately slowing your payments to use your cash somewhere else. The first year you owned the business, you were late making payments because of limited cash flow and an antiquated AP system. The 63 Days payables turnover calculation in this article is reasonable considering general creditor terms. It would be best if you made more comparisons to be sure it’s the right number for your company. Before delving into the strategies for increasing the accounts payable (AP) turnover ratio, let’s understand the reasons behind the need for such adjustments.

With your expenditures categorized, you can monitor your spending at both a micro and macro level, checking that you’re adhering to operating budgets. As a bonus, you’ll be better prepared to report your deductible expenses during tax time. The following two sections refer to increasing or lowering the AP turnover ratio, not DPO (which is the opposite). Barbara is a financial writer for Tipalti and other successful B2B businesses, including SaaS and financial companies.

Another challenge that can impact the Accounts Payable Turnover Ratio is inaccurate data entry. Entering incorrect information, such as incorrect invoice amounts or payment dates, can lead to delayed payments and negatively impact the ratio. It is important to have a system in place to ensure accurate data entry and to regularly review and reconcile accounts payable records to avoid errors. Additionally, the technology industry can benefit from a high Accounts Payable Turnover Ratio. Technology companies often need to purchase components and materials from suppliers to manufacture their products. A high Accounts Payable Turnover Ratio can help them maintain good relationships with their suppliers and ensure a steady supply of materials.

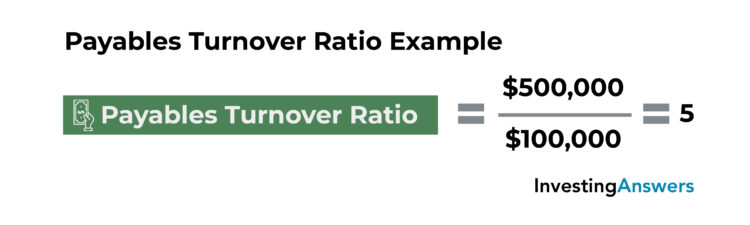

- Similarly calculated, the AP turnover ratio formula is net credit purchases divided by Average Accounts Payable balance for that time period.

- Accounts payable and accounts receivable turnover ratios are similar calculations.

- The company wants to measure how many times it paid its creditors over the fiscal year.

- If your AP turnover target is lower than your ratio today, you’ll need to pay your bills more slowly.

- But as indicated earlier, a high turnover ratio isn’t always what it appears to be, so it shouldn’t be used as the sole marker for short-term liquidity.

For example, when used once, the ratio results provide little insight into your business. If the AP turnover ratio is 7 instead of 5.8 from our example, then DPO drops from 63 to 52 days. A high turnover ratio implies lower accounts payable turnover in days is better. When you receive and use early payment discounts, you increase the AP turnover ratio and lower the average payables turnover in days. By calculating the AP turnover ratio regularly, you can gain insights into your payment management efficiency and make informed decisions to optimize your accounts payable process.

For example, a higher ratio in most cases indicates that you pay your bills in a timely fashion, but it can also mean that you are forced to pay your bills quickly because of your credit terms. If the cash conversion cycle lengthens, then stretch payables to the extent possible by delaying payment to vendors. If your business has cash how to develop an aggregate plan for your operations management availability or can make a draw on its line of credit financing at a reasonable interest rate, then taking advantage of early payment discounts makes a lot of sense. The DPO should reasonably relate to average credit payment terms stated in the number of days until the payment is due and any discount rate offered for early payment.